As part of the tax preparation process this year, many investors should communicate with their tax preparer about interest on US government debt obligations.

Put simply, if you loan money to the US government, then the interest you receive is exempt from state and local income tax. However, you’ll still owe federal income tax on the payments.

The US Supreme Court has listed four items that define a US obligation exempt from state tax:

- Documented in writing

- Interest bearing

- Binding promise by the US to pay specific amounts at specific dates

- Authorized by Congress

For reference, the most common US government obligations include:

- Savings bonds (Series I, Series EE, etc.)

- Treasury Bills, Notes, Bonds

- TIPS

- Certain agency bonds (FHLB, FFCB, etc.)

- Money market funds that invest in US government obligations

- Bond funds that invest in US government obligations

There are a whole host of other US obligations that are less common, so be sure to check with a tax expert if you are unsure.

And here are some important things to keep in mind when considering whether this tax benefit makes sense for you:

- Interest from your bank savings account does not qualify. Even though bank deposits are covered by the FDIC, they do not qualify as US obligations.

- Any interest received in an IRA or retirement plan does not qualify for this tax benefit.

- Some states require that more than 50% of an investment funds assets consist of US obligations, or else they disqualify the deduction. Check with your state tax office or tax preparer for more info.

- If you live in a state without an income tax, then you likely won’t benefit from this tax benefit.

More money, more problems

In recent years, interest rates were so low that most people didn’t miss out on much by forgetting this tax benefit. If you only earned $50 of US obligation interest, then it’s hardly worth the time to bother to report it. But today’s higher rates mean that many taxpayers likely have higher levels of interest payments coming in and higher corresponding potential tax benefits.

For example, if you live in Virginia and have a $100,000 of cash earning an average of 5% from US government obligations, then you could expect a tax benefit of $5,000 x 5.75% = $288, compared to $58 at 1% interest rates.

And if you live in a high-tax state like California or New York, the tax savings could more be significant.

What do I need to do?

To gain the tax benefit, you need to exclude any qualifying interest earned on your state tax return. Unfortunately, this is not an automatic process and requires communication with your tax preparer or heightened vigilance if using tax preparation software.

#1 – Determine how much interest you earned on US obligations.

If you own savings bonds or other debt instruments through treasurydirect.gov, then refer to box 3 of the Form 1099-INT issued to you in January. Keep in mind that savings bonds often allow you to defer taxation of interest payments until maturity or sale, so you may not have any taxable interest payments in 2022.

Next, check the Consolidated Form 1099 provided by your investment custodian. Many custodians provide a section with precise amounts of US obligation interest for your investments.

If your custodian doesn’t include the relevant amounts, then you (or your tax preparer/financial advisor) will need to play detective. Start by looking through your Consolidated Form 1099 and identify securities that might have some US obligations. This list might be bigger than you think as many stock funds hold short-term cash which gets invested in treasury bills, etc.

Most people will have securities offered by major fund providers such as Vanguard, Schwab, or Blackrock.

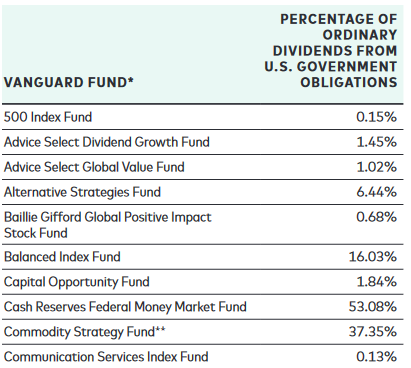

The best way to find the information is to do an google search for “Vanguard tax info” or “Schwab tax info.” Typically, this will bring you to a page that provides a document listing out all of the funds that paid interest from US government obligations. Here’s a screenshot from Vanguard’s 2022 document:

As you can see, the fund providers report the amounts in percentage terms. For example, if you owned the Cash Reserves Federal Money Market Fund in 2022, then 53.08% of the ordinary dividends you received from the fund were from US obligations. You can simply multiply the dividend amounts for that fund by 0.5308 to arrive at the amount of dividends exempt from state tax.

I used the 2022 data as an example above as the 2023 data won’t generally be available until mid-January. The fund providers sometimes also revise the amounts as late as mid-February.

#2 – Report the amount on the state tax return

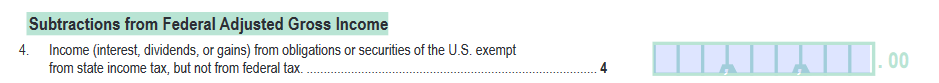

If you live in Virginia, then you or your tax preparer need to report the correct amount on line 4 on Schedule ADJ:

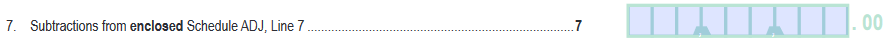

This amount will then flow to line 7 of your Virginia Form 760:

Most states have a similar process for reporting your US obligation interest. The important thing is to communicate with your tax preparer and double check the return forms before filing.

After that, you’re done. As always, be sure to consult with a tax professional if you have any concerns.