In my career as a financial advisor, I’ve discovered that many financial and investment products get overused. Often to the detriment of the client. The most obvious and egregious examples are cash value life insurance or variable annuities.

But surprisingly, I’ve encountered many advisors who overuse more esoteric products such as municipal bonds.

Quick refresher: municipal bonds (“munis”) are bonds issued by state and local governments. They have unique tax benefits, namely that the interest payments are exempt from federal income tax. Interest payments can also be exempt from state tax if the bond was issued in the same state in which the taxpayer resides.

Unlevel playing field

When it comes to municipal bonds, it’s important to remember that not everyone is competing on a level playing field. Munis can be more or less attractive depending on each individual’s personal tax situation.

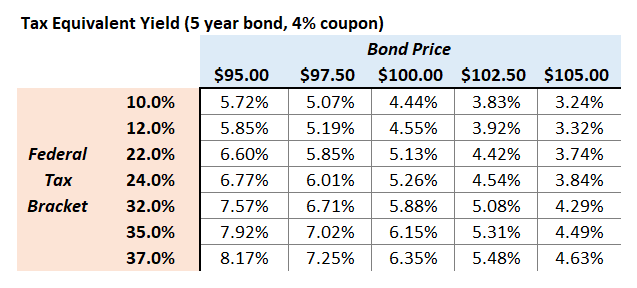

As an example, take a look at the following table outlining a range of tax equivalent yields (TEYs)1 for a 5 year muni bond that pays 4% interest (and assuming the bonds were issued in the taxpayers home state):

One useful way to look at this chart is to start at the top-center. If a taxpayer in the 10% federal marginal tax bracket buys at “par” or $100, the TEY would be 4.44%. If a tax payer in the 37% bracket buys at par, the TEY increases to 6.35%, about 1.9% higher. Same bond at the same price, but the high earning tax payer will receive a 1.9% boost in after tax return.

In fact, the 37% taxpayer can pay $105 (or $5 more) for the same bond and still end up with a higher TEY (4.63%) than the 10% taxpayer!

The lesson here is that municipal bond prices mean different things for different taxpayers. Taxpayers in high marginal tax brackets can pay higher prices relative to taxpayers with lower marginal tax brackets. The folks in low-to-mid level tax brackets are outgunned.

This leads back to my original assertion that municipal bonds are often overused. The vast majority of retired investors find themselves in the 12%, 22%, or 24% marginal federal tax brackets. And it’s often these folks who own municipal bonds when they can often do better by owning ordinary taxable bonds such as US treasuries or corporate bonds.

It’s important to keep in mind that for all bonds (and actually all investments), we should really focus on the expected after-tax returns.

For this cohort of people, perhaps at one time it made more sense to own municipal bonds. Maybe when they were still working they were in a higher tax bracket. But marginal tax brackets are highly dependent on taxable income and can fluctuate from year to year depending on life circumstances, so it’s a good idea to check in occasionally to see if owning munis still makes sense.

In many cases, these folks (or more likely their financial advisors) fail to calculate the TEY on their municipal bond holdings after retirement (or other major life changes) and they miss the

Potential solutions

For many, proper asset location offers a way to level the playing field. Instead of owning munis, what about holding taxable bonds (e.g. Treasuries, agency bonds, corporate bonds, etc.) in a tax-deferred IRA or employer retirement plan? Moving taxable fixed income investments to a tax-deferred account is an investment best practice and is generally part of a prudent asset location strategy that can often help improve an investment portfolio’s tax efficiency.

The benefits of holding bonds in a tax-deferred account are two fold. First, since taxable bond interest and tax-deferred account distributions are both taxed at “ordinary” tax rates, you gain more flexibility over tax timing without incurring much downside. Bond interest income comes in on a regular schedule that we can’t control, but by holding the bonds in a tax-deferred account, we can defer taxes until we are ready to make a withdrawal from the account. Obviously, required minimum distributions (RMDs) somewhat reduce this flexibility.

And, second, by moving bonds into a tax-deferred account, we can create more room for owning stocks or other tax efficient assets in our taxable investment accounts. And there are six main benefits to holding stocks in a taxable account:

- Step-up in basis at death of the owner

- Tax loss harvesting

- Can donate appreciated stocks to charity

- Tax paid on foreign stock dividends are eligible for a foreign tax credit

- Long-term capital gains and qualified dividends are taxed at lower rates

- Capital gains are due only when realized, which allows built-in tax deferral.

If you own munis in your portfolio, that’s not a problem per se. But it’s important to actually do the math periodically to determine if they still make sense.

Out-of-state bonds

Generally, investors subject to state income tax should confine themselves to municipal bonds issued within their home state. Interest payments from out-of-state munis incur taxes from the home state, which erodes the overall tax benefit of owning munis. In most cases, only residents of states with zero (or low) income tax rates (e.g. Florida or Texas) should own out-of-state bonds.2

Unfortunately, it can be difficult to access state specific bond funds at a low cost, unless you live in high-tax states like California or New York. For example, Vanguard only offers state-specific muni bond funds for the following states with pricing right around 0.10%:

- California

- Massachusetts

- New York

- New Jersey

- Ohio

- Pennsylvania

However, if you live in Virginia, then the most popular muni bond that I’ve found is offered by T Rowe Price. But is carries a 0.56% expense ratio (or if you have $1,000,000 to invest you can get the cheaper share class at 0.46%).

Owning individual bonds

To get around the issue of state specific fund costs, you could purchase individual bonds from your home state. However, that introduces risks around diversification and managing credit risk.

And I generally advise people to avoid owning individual bonds of any kind – with one caveat later. Much like individual stocks, it’s almost impossible to pick individual bonds that will outperform a low-cost, passive index. Lots of people try, most people fail.

Also, buying and selling individual muni bonds isn’t cheap. The bid/ask spread, or difference between where you can buy or sell a given bond, can be very wide for retail investors. And many muni bonds don’t trade very often, so it can be tricky to find good pricing.

This really comes down to a size constraint. The vast majority of retail investors have portfolios of $5 million or less. Let’s assume we allocate half – $2.5 million – to fixed income/muni bonds. Let’s also assume that we wish to diversify at least a little bit. We decide to target equal weighted ownership of about 20-30 individual bonds across various maturities and issuers. This means we can invest between $83,333 and $125,000 per individual issue. Believe it or not, that’s small potatoes in the world of bond trading. Any dealer will likely, and somewhat justifiably, add in an extra “spread” (e.g. trading cost) for having to deal with the hassle of a smaller size trade. It my opinion, trading muni bonds is often best left to seasoned professionals.

However, there is one caveat to owning individual bonds. If you are buying US treasuries – especially short term t-bills – then you don’t need to worry as much about the risk of individual issues. US treasuries are backed by the US government, so they are generally considered to have a close-to-zero risk of default. And bid/ask spreads on treasuries are very tight, as the market for US treasuries is huge. You’ll still need to consider factors such as interest rate risk, but it would not be entirely unreasonable to own a single t-bill as a stand-in for your portfolio’s fixed income exposure.

In summary, if you own muni bonds or think they might make sense for your portfolio, be sure to periodically check in on them. Calculate the TEY and compare it to other available bonds. And if you are in a low or mid-level tax bracket, you will often find that munis are all they are cracked up to be.

1 Treasury equivalent yield (TEY) essentially “corrects” for the disparate tax treatment of different kinds of bonds. In effect, it allows us to compare Treasuries, MBS, corporate, and muni bonds on an “apples-to-apples” basis.

2 If you live in a state with shoddy finances and are worried about credit risk, it’s likely that skipping munis altogether is the best course of action, rather than investing in out-of-state munis.