Noble Hill Planning is a flat fee financial Advisor

$6,000 per year for each client relationship*

We are passionate about helping our clients achieve financial success. One of the best predictors of future investment performance is cost. All else being equal, lower costs will lead to higher returns. So we intend to do everything we can to keep costs in check. And that starts with charging a reasonable fee.

Reducing Conflicts of Interest

It is difficult to get a man to understand something when his salary depends on his not understanding it.

-Upton Sinclair

Imagine you have some extra savings in your bank account. Should you pay off your mortgage or invest in the market? If your advisor charges the typical 1% fee, then there is a financial incentive to steer you away from paying off the mortgage. Instead, your advisor might encourage you to add the extra savings to your investment portfolio. And conveniently, your advisor will earn a higher fee if you follow their advice.

There are many other scenarios where the typical 1% fee causes conflicts of interest. From 401(k) rollovers to the timing of Social Security claims, the typical financial advisor earns more or less depending on what you choose to do. And in many of these situations, the advisor’s financial incentive will conflict with your own best interests. You don’t want to be in a situation where you need to make an important decision around your retirement, and you can’t have complete trust in the advice provided to you.

Our flat fee can reduce or eliminate much of the biased advice in these situations. It allows us to remain 100% focused on your financial success.

A Quick Cost Comparison

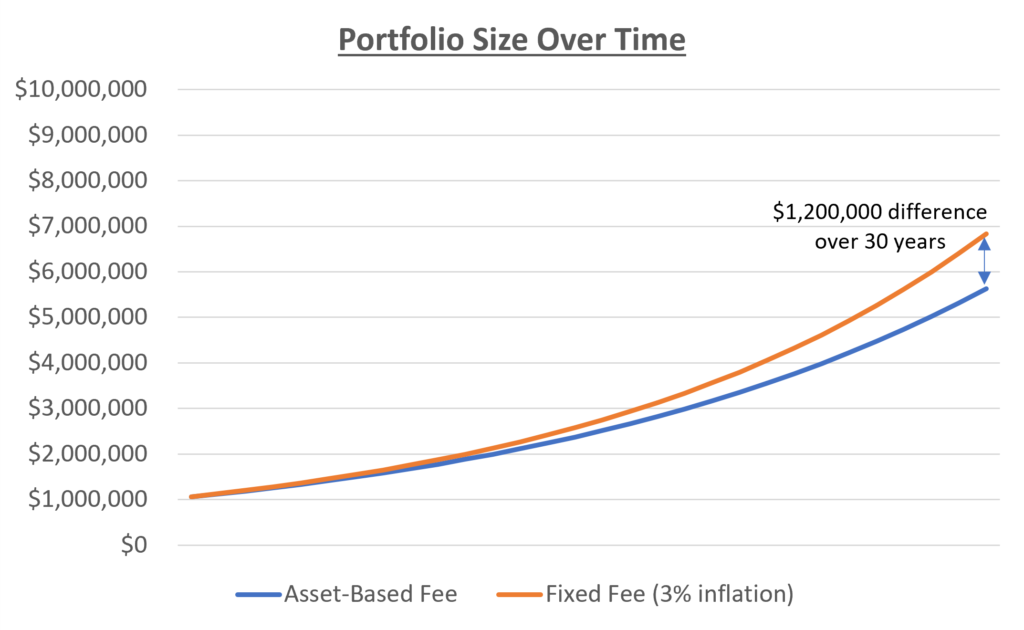

The typical 1% advisory fee can present significant problems for clients. As the portfolio grows over time, these asset-based fees can act like an anchor on investment growth.

For example, if you start with a $1 million portfolio and earn a 7% return before fees, after 30 years our flat fee structure results in $1.2 million of additional wealth compared to the asset-based fee. That extra cost can erode your chances for long-term financial success.

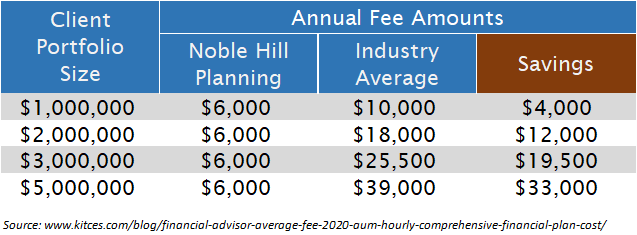

Our Fees vs. Industry Average

Over time, your advisor’s fees can get out of sync with the value you receive. Paying an advisor 1% on a $500,000 or $1,000,000 portfolio may seem suitable for some clients. But does that same asset-based fee make sense for a $2,000,000 portfolio? What about a $5,000,000 portfolio?

*In very rare circumstances, we may increase our fee based on a variety of factors including, but not limited to, portfolio size or complexity.