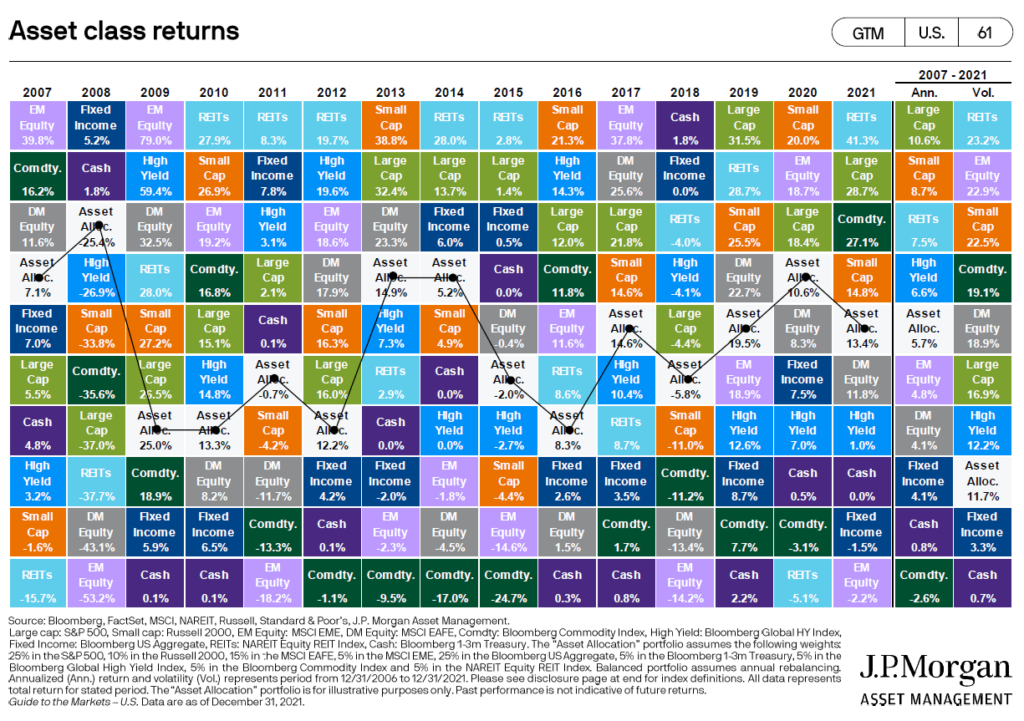

Here’s a great chart that often doesn’t get enough attention in the financial media:

The lesson here is that diversification matters. As you can see, the performance of each individual asset class randomly bounces around compared to the others year after year. But if you package a variety of asset classes into a prudent asset allocation framework, you will generally earn returns close to the middle of the pack.

And the bonus is, you can do it with less risk. Take a look at the last two columns on the right. From 2007-2021, the asset allocation portfolio returned 5.7%/year. Good enough for 5th place out of 10. But the volatility of the asset allocation portfolio was lower than all other asset classes except for fixed income and cash. And that’s the whole point of using diversification. It allows your portfolio to generate adequate returns to meet your financial goals, but with fewer bumps along the way.

Think about diversification like eating a balanced diet. On your plate you have vegetables, protein, carbohydrates, and maybe a sweet treat! All together they provide your body everything it needs to thrive.

Or you can think of it like an elevator with multiple safety cables. I don’t know about you, but I would prefer elevator 2.