I’ve spoken with some people who ask the following question about my fee schedule, “Hey, my current advisor charges 1%, so if he grows my portfolio his income goes up. What’s your incentive to grow my portfolio?”

My honest response is to chuckle a bit. The incentive built into the typical “%-of-assets” fee structure isn’t to grow your portfolio or improve portfolio performance, it’s merely to gather assets. If a financial advisor was serious about designing an incentive to improve performance, they would use a “%-of-gains” fee structure.

In fact, that’s the exact fee structure that Warren Buffett used when he first started his investment partnerships in the 1950’s. Buffett charged zero management fees (that’s right, zero), but he took 25% of the investment gains from the portfolio as his fee, but only on the portion of the gains above 6%.

Needless to say, Buffett’s fee structure provided a tremendous incentive to boost investment performance, as he didn’t get paid a dime if the portfolio returned less than 6% and there were huge rewards for exceeding that threshold. As we all know, with the proper incentives, Buffett did a great job for his clients, and himself.

Gather assets, not improve performance

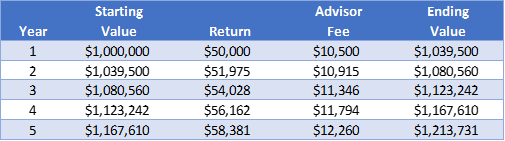

Why do I say that the “%-of-assets” fee structure incentivizes advisors to gather assets? Well first, it’s right in the name. And second, think about it from the advisor’s perspective. If you have a $1,000,000 portfolio that grows at 5% per year. That means your advisor’s fee will grow at roughly 4% per year (5% gross return – 1% advisor fee). So the first five years of the portfolio will look like this:

Based on this, the advisor earns a total of $56,815*.

Now let’s assume your advisor wants to boost your portfolio performance (i.e. try to beat the market) and increase their fee. The advisor works extremely hard and overcomes the odds (which are stacked against him). And your gross portfolio returns increase to 7% per year. Now the advisor’s fee looks like:

With the improved performance, the advisor earns $60,233 for an increase of $3,418. Your advisor has done what many investment managers cannot, and outperformed the market by 2% for five years. And they earned an extra…. $3,400?!?

Now let’s consider gathering assets. Assume the advisor can convince you to add $100,000 of assets to the portfolio every year, either through regular savings or something like a 401(k) rollover. Now the advisor’s fee looks like:

Under this scenario, the advisor’s total fee over five years increases to $67,738. The advisor has boosted their fee by almost $11,000. No need to spend time poring over investment research to find the best investments. No need to engage in brutal competition with all the other active investment managers in the world. All the advisor really needs to do is be nice to you (or other potential clients). And occasionally ask for more of your assets to manage.

You can also be sure that gathering new assets is a whole lot easier than trying to improve investment performance. And that’s the reason why, when you retire, your advisor will politely ask you if you would like to rollover your 401(k) plan to an IRA, which they can then manage and charge a fee on. In fact, the future growth prospects of many advisory firms rely heavily on the potential for convincing clients to rollover their 401(k) plans when they retire. Some advisory firms have even gone so far as to just skip the need for a rollover and merge with the 401(k) manager.

Arbitrary fees

Another thing I find exasperating about the “incentive” argument is the arbitrary nature of the fee level. Why does a 1% stake in your portfolio provide the best incentive for your advisor? Why not 2% or 5% or 10%? If your advisor is motivated by 1%, isn’t it logical that they would be doubly-motivated by 2%? What about advisors using tiered fee schedules (i.e. 1% on first $2mm, 0.8% on next $3mm, etc)? Is the advisor less motivated to grow the higher dollar amounts? All of these are legitimate questions with no real defensible answers, especially when compared to a flat fee.

Potential for biased advice

One final thing to consider is the biased nature of the asset-based fee structure. Consider the following situations that you might bring to your financial advisor:

- Should I leave my 401(k) where it is, or execute a rollover?

- Should I withdraw funds from my portfolio to buy a fixed annuity to augment Social Security?

- Should I pay off my mortgage or invest with you?

- Is it a good idea to buy a vacation property?

In each of these scenarios, the advisor using a typical asset-based fee has a clear financial incentive to advise you in one direction vs the other. And the advisor’s financial incentive can often conflict with your own best interests.

Does this that mean that ALL advisors using asset-based fees give bad advice? Definitely not. Many of them are great people who are capable of setting aside their conflicts and acting in the client’s best interest. However, the potential for biased advice remains and many advisors won’t lose a single second of sleep over dispensing advice that supports their bottom line at the expense of the client’s interests.

It’s up to you as the client to have awareness around biased advice and to protect your interests. Ask a lot of questions. And don’t be afraid to demand that your advisor clearly demonstrates how they mitigate their conflict of interest in these situations.

It’s worth noting that working with a flat-fee advisor can remove a lot of the doubt in these situations. By removing the financial incentive of biased advice, a flat fee advisor oftentimes can help you drill down to a more honest and transparent relationship. One where the focus is on giving the best advice possible for your situation, not trying to increase the size of the advisor’s wallet.

* That amount is notable because it represents 21%!!! of the total gross return from the portfolio over the five year period. I’m not sure it makes sense that an advisor takes 0% of the risk, and earns 21% of the rewards. But that’s a discussion for another time.