Many market forecasters (although not all) are predicting lower future returns for investors. Keep in mind that these same market forecasters have been wrong for years and nobody can predict the future. Any market forecast must be taken with a grain of salt. However, there are some good reasons to expect lower future returns. All-time low interest rates, high stock market valuations, and above average corporate profit margins to name a few. So if the future does hold lower returns, what can the average investor do?

Reduce costs

Reducing fees is the most effective method, by far, that an investor can take to improve returns. Fee reductions provide a 1-for-1 improvement for investment returns. Every dollar you save in fees, means one more dollar stays in your portfolio and compounds over time.

Thanks to Jack Bogle (aka the patron saint of the amateur investor) investment management fees have fallen off a cliff over the past 30 years. Passive and active investment funds alike have lowered their fees and the average investor today has a golden opportunity to create a great investment portfolio for very little cost.

But what about fees for financial advisors? Unfortunately, there hasn’t been as much progress on that front. The conventional 1% of assets fee structure remains entrenched as the dominant model. It’s funny to me that many financial advisors will preach all day about the virtues of a passive, low-cost investment strategy, but when it comes to reducing their fees? Fuggedaboutit! This makes no sense.

Why can’t large brokerage and advisory firms take advantage of economies of scale and pass cost savings along to their customers? These firms manage billions or even trillions of dollars, but have provided little in the way of meaningful fee improvements for clients. Perhaps it’s because they need to pay for their massive marketing budgets, opulent offices, and lawsuit settlements.

Even smaller, independent advisory firms ($100 – $500 million of assets) can often employ technology or operational updates to reduce costs and pass savings along to clients. And in case anyone forgot, that’s how capitalism is supposed to work. Alas, we can only play the game in front of us, so it’s up to individual investors to find a better way.

So if you’re worried about lower returns, start by reducing fees. If you currently work with a financial advisor who stuffs your portfolio with high-priced investment products, you have the potential to improve returns by 1-2% per year by making some easy changes. That’s not a bad start.

Tax efficiency

In addition reducing your investment and advisory fees, it’s important to focus on taxes. Start with less turnover in your portfolio. Less market timing and fewer “tactical” adjustments give your investments a better chance to grow without the year to year tax drag. Exchange traded funds (ETFs) can also offer important tax benefits over mutual funds. Tax deferral has real value, so don’t waste it.

Asset location can also help. Here is a good chart from Fidelity that outlines the general rules for tax location.

Unfortunately, tax optimization is not as beneficial as reducing investment fees, but I estimate that the average investor can increase returns by 0.25-0.50% per year with a solid tax optimization strategy. Combined with the fee reductions above, and the average investor can improve returns by 1.25% – 2.50%.

Increase savings

The next step to handle lower returns is to increase your savings rate. Increasing savings has the dual benefit of adding more capital to your investment portfolio, while simultaneously forcing a reduction in current spending. If you can afford to live with a higher level of savings and the corresponding reduction in your cost of living, then you will be well served in retirement.

Dynamic withdrawals

For a long time now, the “4% rule” has been the de facto standard when it comes to estimating how much money you need to retire. The thinking goes if you need to withdraw $40,000/year from your portfolio for living expenses, then you need to aim for a $1,000,000 retirement nest egg (e.g. 4% of $1mm = $40k).

Lower expected returns can change the calculation though. Morningstar had a recent post that indicated that 3.3% is new 4%. So instead of $40,000, you can only safely withdraw $33,000 every year. One thing you can do, and which many people in the real world do anyway, is to employ a dynamic (or variable) withdrawal strategy. A dynamic strategy can allow you to take a higher percentage of your portfolio to start. In exchange though, you must be willing to adjust your portfolio withdrawals up or down in response to investment performance.

In the financial planning world, the Guyton-Klinger Guardrails are the most well known of the dynamic withdrawal strategies. An example might look like this:

- Start with a 5% withdrawal rate in year 1 ($50,000 on $1 million portfolio)

- Recalculate your withdrawal rate at the beginning of year 2

- If your withdrawal rate is greater than 6%, reduce your withdrawal amount by 10% (down to $45,000)

- If your withdrawal rate is less than 4%, increase your withdrawal amount by 10% (up to $55,000)

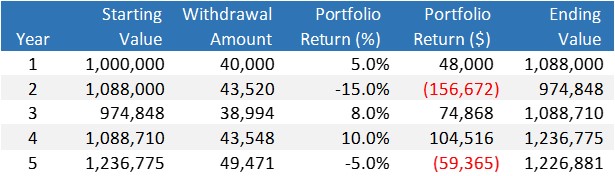

You can also use something called the endowment model. For this approach, you withdraw a fixed percentage of your portfolio each year. Assuming you withdraw a dynamic 4% of your portfolio every year, one spending path might look like this:

As you can see, portfolio withdrawals rise and fall in response to positive or negative investment returns. Thankfully, when you factor in Social Security or pension income, the fluctuations aren’t as severe as they seem. And one great thing to remember… there is solid evidence that a dynamic approach to retirement spending can reduce the risk of running out of money in retirement!

Choose the right risk profile

Historically, it didn’t matter too much what asset allocation you used in retirement, but if lower returns do come to pass, then the asset allocation choice becomes more important. Here is an interesting pair of charts:

Notice that historical success rates were sky high for almost any portfolio with more than 20% equity exposure. But future success rates look considerably worse, especially for portfolios with lower equity exposures. Today’s crop of retirees should likely get comfortable taking on more equity risk when preparing for and going through retirement.

Increase diversification

The last thing we’ll cover is diversification. Many investors have a significant bias to their home country. This is especially true for U.S. based investors since we have the world’s largest stock market. But it’s important to invest globally. There is good current evidence that foreign equity markets offer more attractive valuations compared to the U.S. equity market.

It’s also important to consider exposure to a variety of evidence-supported investment factors, namely small companies and value companies. Many small-cap and value investors have been pulling their hair out over the past 10 years as big, growth companies like the FAANG stocks have provided amazing returns. But we all know trees can’t grow to the sky. At a certain point small-cap and value stocks could start to catch up.

If you haven’t considered any of the points covered here, I recommend that you take another look. If you work with a financial advisor, speak with them about some of these (especially the fees!!!). Every little bit can help, and these are places where a worthwhile financial advisor can add some value.