In my mind, the debate between active vs passive investment management is settled. Passive investments outperform active investments in so many ways that it’s really an illusory debate at this point. Most of the people defending active investment management are the active managers themselves. And as we all know, when your compensation is tied to something, it’s hard to argue against it.

One under-the-radar way that active investment management can set you up to fail comes from a “tax trap” embedded in many active mutual funds. When an investor buys a mutual fund, they get a cost basis on the shares they purchase, much like investing in an individual stock, real estate, or any other capital asset. However, the mutual funds themselves also have a cost basis on any positions they purchase within the fund. And if the fund manager chooses to sell a position with capital gains, then the fund must distribute the newly realized gains to the shareholders of the fund.

Managers choose to sell positions for all sorts of reasons. An innocuous reason might be that they have changed their opinion about a company or business, or find it to be overvalued. Not big deal there. The problems start when active funds begin to underperform the market. Everyone loves a winner right? And the opposite is also true. No one wants to pay an active investment manager to underperform the S&P 500.

So if an active fund manager starts to fall behind their benchmark, many investors will start to look for the exit. And if an investor sells their shares in the fund, then the fund manager must come up with cash to redeem those shares. It’s unlikely that there will be new cash coming in from other investors (after all the fund is underperforming). So the fund manager must sell positions to raise cash. And that’s when the fund starts to distribute significant capital gains. Hence, the tax trap.

An Example

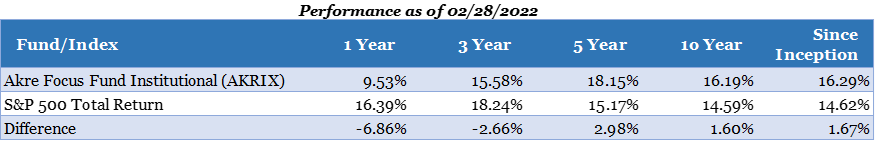

Let’s look at the Akre Focus Fund (AKRIX)1. If you had the foresight (or good luck) to invest in this fund at inception and stick with it for the long term, you are likely pretty happy. Here are the historical performance figures as of 2/28/2022:

So any original investors who held on until the end of February outperformed the S&P 500 by 1.67% per year. But you’ll likely notice that the more recent performance (1 Year and 3 Year) has not been so great compared to the benchmark. And as I mentioned earlier, that underperformance can generate a tax trap.

Take a look at the historical distributions for AKRIX from the past few years:

Before 2019, the capital gains distributions were pretty low. But in 2019 and 2021, there were significant distributions. So if you decided to invest in this fund back in 2019, not only have you underperformed the S&P 500 benchmark, but you have also been gifted the honor of paying taxes on capital gains from which you never really gained any benefit as they were accrued over years prior, but never realized until more recent years.

The tax trap accelerates

And this tax trap problem can accelerate with future underperformance. If an active manager fails to keep up with the benchmark for long enough, even the most diehard believers will lose patience and sell their stakes. More capital leaves the fund and the managers are forced to sell more positions and realize more gains. If a new investor comes along and steps into the middle of this process, it can be devastating.

You might wonder, “Won’t investors avoid selling so they don’t realize their own personal capital gains?” As I’ve written before, that’s certainly possible. But some of the investors could be non-profit institutions, so they might not even be concerned about taxes. Other investors might be holding their position in a qualified account where capital gains don’t apply.

All of this is to say that you should be wary when considering active mutual funds. If the fund has been around for a while and has a large amount of embedded capital gains, then you might want to steer clear. Or at least consider investing in the fund through a qualified account such as an IRA.

Do passive funds have the same tax trap?

It’s also important to note that many passive funds don’t have this tax problem. For one, exchange traded funds (ETFs) have a creation/redemption mechanism that allows the funds to remove low cost basis shares from the fund. And two, passive funds don’t underperform (or at least not much), so investors aren’t tempted to jump ship at the first sign of trouble.

1 I’m not trying to pick on Chuck Akre and his team. If you’re familiar with him, then you know that he’s a very talented money manager. You could do a whole lot worse in the active fund space. He does a good job of being “weird”… that is, he concentrates his portfolio, takes on significant active risk, and avoids “closet indexing.” Which is exactly what you want to see from an active money manager.