Update on 9/2/2022: Well that didn’t take long. After the initial round of press coverage around this issue, Virginia’s Department of Taxation issued a statement indicating that student loan forgiveness will not be taxable under state law. North Carolina and three other states will likely be the only states that will tax forgiven student loans as income.

As you might know, President Biden will seek to forgive between $10,000 and $20,000 of student loans for certain borrowers. Reading through the plan, it occurred to me that forgiven debt often is treated as taxable income for the debtor. So how will this affect tax planning for 2022?

You don’t have to worry about federal taxes thanks to the American Rescue Plan Act of 2021 (ARPA). ARPA excluded student loan forgiveness from taxable income for the tax years 2021 through 2025.

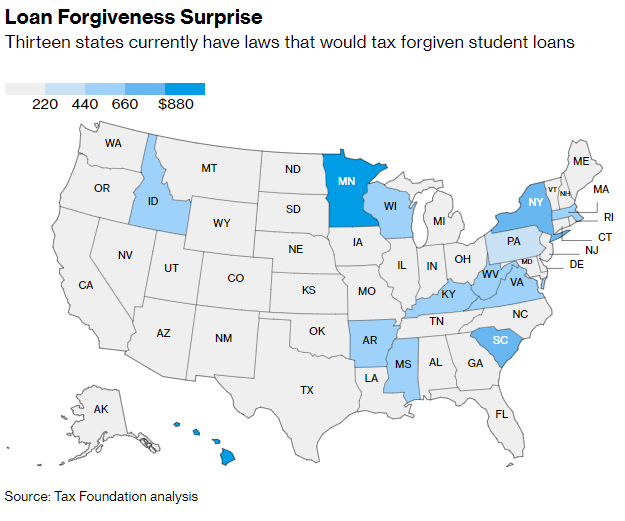

What about state taxes? This Bloomberg article mentions 13 states which tax forgiven debt as income. Here is a map from the article:

It’s possible that Virginia (and the other states) will NOT tax forgiven student loan debt as income. However, we will have to wait to find out.

Per Tax Bulletin 22-1, the Virginia General Assembly passed conformity legislation to sync up with the ARPA for 2021. There is no word yet on whether these changes will apply to the 2022 as well. It’s important to note that the conformity legislation was signed on February 23, 2022, well into the 2021 tax season.

If you (or someone you know) ends up receiving student loan forgiveness, it’s a good idea to set aside funds to cover the tax obligation. For $10,000 of debt forgiven, this would equal $575. For $20,000, it would equal $1,150. Otherwise, it’s possible that you could find yourself in a difficult position next tax season.

As always, check in with your tax advisor for more information and any updates on this issue. It could be worth keeping an eye on this over the next few months.