Here is an interesting graphic that made the rounds recently:

What does this mean?

In a nutshell… if you want to the earn the same return that retirees did in 1995, you need to take more risk. And if taking that extra risk is not possible, then you might need to adjust your spending levels and financial goals. People entering retirement today need to be aware that riding the ups and downs of the market isn’t optional, but required in many cases.

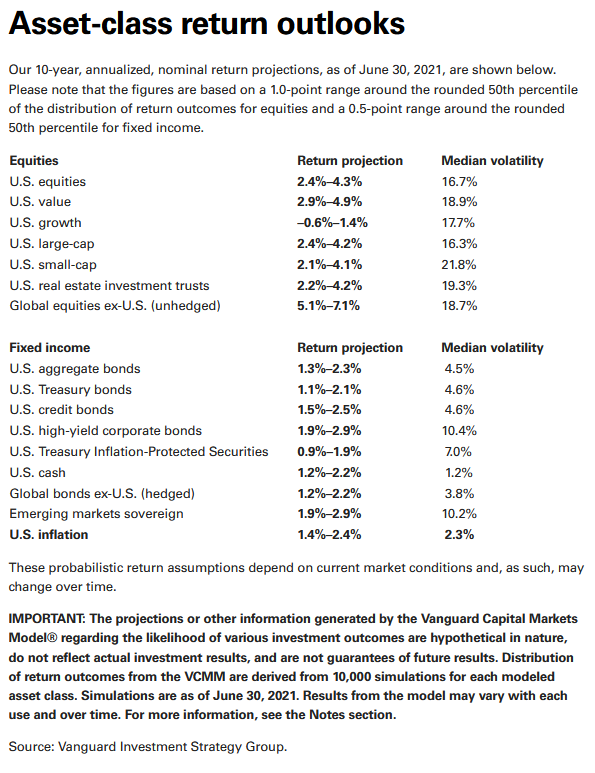

I would also argue that the graphic doesn’t fully convey today’s market environment as generating a 7.5% return today will be difficult without taking some very high levels of risk. Based on the below table of 10-year return projections from Vanguard, I estimate that a more reasonable rate of return is 3-4%.

So What Can You Do About It?

Manage your expectations and focus on what you can control. Make a plan and decide what process you will follow when the market drops. If you’re still working… save more or consider delaying retirement for a short while. If you’re retired… double check your spending and asset allocation. Consider reducing your investment costs. Keep a long-term perspective and stay disciplined.