If you have an IRA that you inherited in 2020 or later, the last few years have been quite confusing when it comes to determining whether or not you must take a required minimum distribution (RMD) from that account.

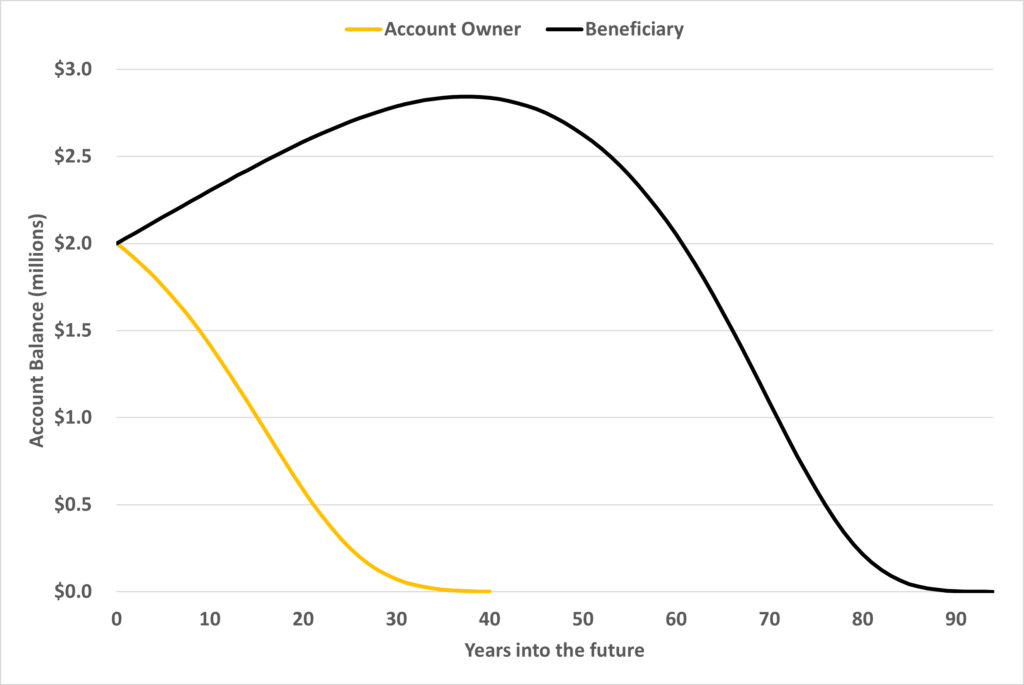

Under the old rules, many people who inherited an IRA had to take an annual RMD, but they could “stretch” distributions from the account over their lifetime. This treatment offered a tremendous tax benefit for people with large IRAs. For example, if an 80 year old person died with a $2 million IRA and left it to their 15 year old grandchild, the RMD amounts associated with those assets drop significantly and would allow that grandchild to enjoy tax deferred growth on those assets for another 50+ years!

Below is a chart illustrating how much longer the assets could remain sheltered in the IRA under the stretch provision (obviously a tremendous loss of tax deferral value from the change):

Assumptions:

$2mm starting value

3% real growth

Account owner starting age = 80

Beneficiary starting age = 15

However, the SECURE Act of 2019 did away with the stretch provision and implemented a new “ten-year rule” for people who inherited IRAs after January 1, 2020. Under the ten-year rule, you must withdraw all assets from the account (and pay any associated taxes) within 10 years.1

Many finance and accounting professionals (including myself) interpreted this rule as waiving the requirement for annual RMDs. But the IRS determined that we were wrong and requied annual RMDs in addition to the ten-year rule.

Due to the confusion, the IRS waived RMD penalties for IRAs inherited in 2020 and 2021. But this year it seemed as if they were going to finally start holding everyone’s feet to the fire.

Well, they are not. Once again, the IRS announced zero penalties on any missed RMDs for IRAs inherited in 2020-2022. That’s good news for owners of inherited IRAs!

However, keep in mind that these rules are not settled yet. The IRS is still on the path of implementing their proposed rules in 2024 and who knows, maybe Congress will pass another huge tax law before then and create even more confusion.

1 The argument in favor of this change was that IRAs were always intended to support an individual’s (or spouse’s) retirement, not act as a long-term tax shelter for heirs. This makes logical sense, but it sure was a loss of value for some people with large IRAs.