Step 1: Use SMART goals

Setting goals for your investment plan is the most important part of the process. If you don’t know where you’re going, how can you ever expect to get where you want to go? If you are creating an investment plan, don’t rely on ambiguous goals like, “I want peace and security”, “I want the freedom to travel”, or “I want to do what I want to do, when I want to do it.” It’s important to get the details ironed out, and for that we can use the SMART criteria.

First developed in 1981, the SMART criteria provide a framework for goal setting. The five criteria are:

- Specific

- Measurable

- Attainable

- Relevant

- Time-bound

Every investment plan needs to start with SMART goals. For example, if you are saving and investing for retirement, your SMART goal might look like:

I want to accumulate $1,000,000 (in today’s dollars) in the next 15 years. I will save and invest an average of $50,000 per year with a target return of 4% per year after inflation.

Step 2: Plan for risk

The next step is to ensure you have a plan for when things don’t go well. I hate to say it, but every investor will face multiple periods of large negative market returns in their life. Here is a good chart that demonstrates just how common market declines are:

Every 6 or so years, you can expect your stock investments to lose 20% or more. Over a 50 year investing time horizon, that means you can count on having to endure 8+ market events that will make you feel sick to your stomach. It’s important to have a plan for when, not if, these events come to pass.

Risk questionnaires

Many advisors will ask you to fill out a form with a series of questions in an effort to determine your “risk tolerance”. I don’t put a lot of confidence in this methodology, primarily because people can change their minds. If the stock market is at an all time high, people tend to have a boundless tolerance for risk. But when the market is getting crushed, those same people will claim they have zero tolerance for risk. So how can you determine how much risk to take?

Start by looking at what you did during the most recent market sell-off. Ask yourself, “What did I do with my investments back in March 2020?” If you sold investments, then you were taking too much risk so you’ll want to dial it back going forward.

Another way to choose an appropriate amount of risk is to decide how many years of portfolio withdrawals you want to keep in safer or more stable assets. For most investors nearing or in retirement, they will be just fine by keeping about 4 to 6 years of withdrawals in bonds or cash. So if you need to withdraw $25,000 per year from your portfolio in retirement, then aim for keeping $100,000 – $150,000 in more stable investments and invest the remainder of your portfolio in securities with a better chance of appreciation and growth.

When the market does drop, you can pull funds from that stability bucket and wait for your growth assets to rebound. When the stock market comes back up, sell some stocks to replenish the stability bucket. If you want to increase or decrease your risk level, consider keeping less than 4 or more than 6 years of portfolio withdrawals in the stability bucket.

Step 3: Define your asset classes

Now you need to decide which investment tools you will use. There is a wide range of asset classes that you can incorporate into your investment plan. But I like to keep it simple so here is what I recommend:

- U.S. Stocks

- International Stocks

- Cash and Bonds

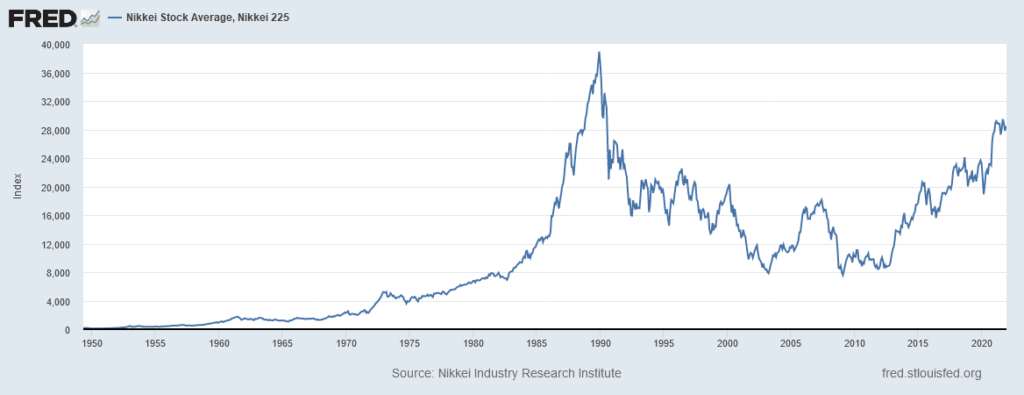

Obviously, within your allocations to U.S. or International stocks, you can include small companies, “value” companies, and a whole host of other investment “factors.” I also include real estate under the stock umbrella. International stocks can help you avoid “home country bias.” If you live in the U.S., you likely invest primarily in U.S. companies. Home country bias has worked great for U.S. investors over the past 10 years, but that won’t always be the case. For an example of what can go wrong, take a look at stock prices in Japan:

Around 1990, the Nikkei was almost at 40,000. Over the next 15 years, it fell down to 8,000 (down almost 80%). 30+ years later, it still has not matched the all-time high.

Step 4: Keep costs low

Now the rubber meets the road and you need to select the specific investments that you want to include in your portfolio. Rule #1 – keep costs low. Use passive, low-cost index funds. Rule #2 – keep it manageable. If your entire portfolio is comprised of a few passive index funds, that’s great. As I mentioned before, you can incorporate additional factors such as value, size, momentum, but be aware that increased complexity carries a burden of extra time and effort.

Don’t get too worked up over trying to pick the “perfect” investment portfolio or perfect investment fund. No such thing exists. Almost any portfolio with broad diversification and low costs has a solid chance of meeting your needs.

If you work with a financial advisor, don’t forget to include their fees in your cost calculation. The typical 1% fee charged by advisors can be a significant drag on your investment returns. For many clients, the financial advisor’s fees represent their single highest expenditure every year. Make sure the advisor is earning that fee or consider alternatives.

Step 5: Set a rule for rebalancing

There has been tons of research done on the best methods for rebalancing. What does the research tell us? Not much. There have been no conclusive findings. I recommend you keep it simple:

- Take a look once per year.

- Take a look after a large up or down movement in the market.

- When you take a look, rebalance if allocation is 15%+ away your target.

Feel free to rebalance more or less frequently. However, you might drive yourself crazy by rebalancing every month or quarter. As I said, the research doesn’t point to any optimal rebalancing frequency, so just do what’s comfortable and convenient for your situation. No perfect formula here.

Step 6: Never give up, never give up, never give up

Last but not least, please don’t give up. The most costly errors I have seen investors make in my career came during large market crashes. Panic, sell everything, wait months or years before reinvesting, regret. This is a train wreck for an investor and it can be the difference between retiring at 60 or 70, or leaving your kids a $1,000,000 inheritance, or nothing at all. Some say it’s always darkest before the dawn, and with investing that can often be the case. Set up your investment plan and stick with it.

Don’t worry if you do find yourself feeling scared in the midst of a market sell-off. It’s normal to have those feelings. If you work with a financial advisor, give them a call and share your concerns. They can likely provide some good options to consider. If you don’t work with an advisor, talk to a trusted friend or family member.