Here’s an oldie but a goodie.

Below is a research report from Morgan Stanley from back in June 2008 (in the midst of the financial crisis).

Here are the key points to notice:

- Then-current share price for Lehman Brothers = $22.25.

- Analyst’s price target = $31.00

- Analyst’s rating = Overweight (aka buy it)

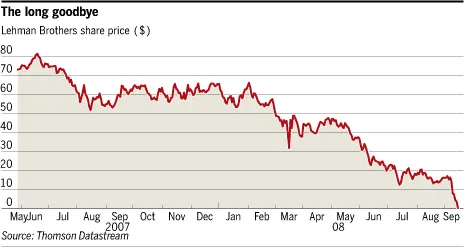

And here’s a price chart of what happened:

Lehman filed for bankruptcy on September 15, 2008. For reference, that was two and a half months later.

I can almost admire the courage it must have taken for the two analysts on this report to make this call in the face of a full on meltdown in the financial system. Never mind the fact that Lehman Brothers’ stock price had been trending straight down for almost a year. They went with, “It’s a buy!”

In the financial industry, this is referred to as “catching a falling knife.” My first job out of college was at Wachovia in 2007. During this same period, Wachovia’s stock price kept falling, falling, falling. But I knew a senior manager who would daily proclaim, “Wachovia stock is a buy! Just look at how high the dividend yield is!” Then Wachovia’s management team cut the dividend to zero (so much for the dividend yield), and the company nearly imploded before Wells Fargo stepped up and bought the remnants.

Keep this in mind the next time your broker or financial advisor quotes an “analyst report.” Even the smartest experts can’t predict the future, and they often get things spectacularly wrong.