One of the most important things to keep in mind when investing is to avoid making a casual attempt. A better course of action is to go all in on whatever you decide to do. So if you want to invest passively, do that for 100% of your portfolio. And the same goes if you prefer active investing.

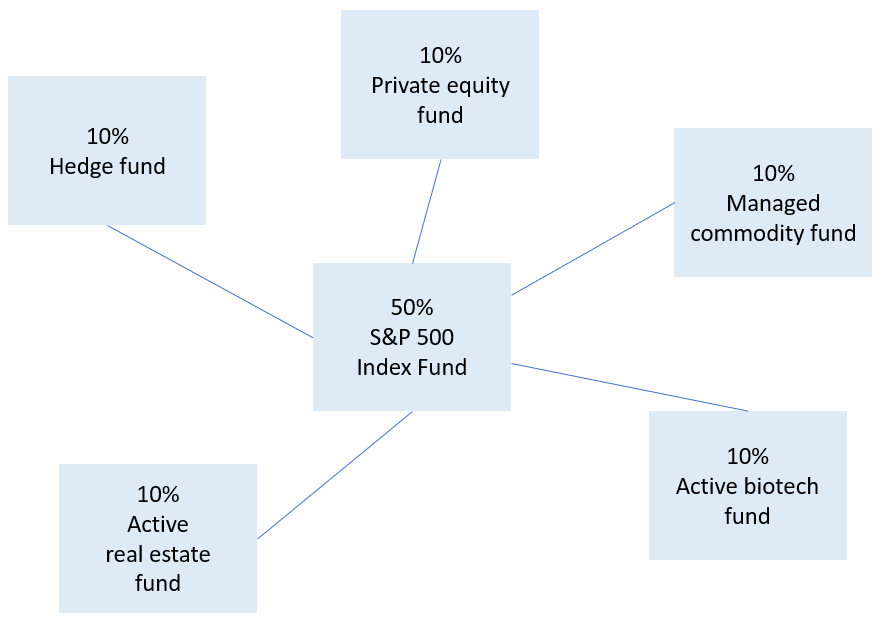

Lots of advisors will pitch something called a “core and satellite” investment approach. With the idea being that you have a “core” portfolio consisting of standard low-cost, passive investments. Then around that core, you add on a series of “satellite” investments, which are typically actively managed. Here is a simple example:

The main risk with the core-satellite approach is that active investing is extremely difficult, and to do it well, you need to devote extensive resources and determination. If you only make a casual, or half-way, attempt then it’s likely that you will fail. The odds are especially daunting when you consider that the competition (i.e. all the other active managers in the world) can bring tremendous intellectual talent and resources to the the active investing table.

Some investors might argue, “But I’m only allocating assets. And I’m using professional investment managers to pick securities and handle market timing.” Unfortunately though, even researching and selecting the best possible active managers is a full time job.

As an individual investor (or even a smaller institution without a recognized brand name), you start off at a disadvantage. Most (OK pretty much all) of the best active managers in the world have people beating down their doors. So they won’t take your money. That means you need to find a “unknown” manager before everyone else discovers them. And if you aren’t spending 100% of your time focused on that, then all I can say is good luck.

David Swenson, the former (and legendary) manager of Yale Univerisity’s endowment fund, wrote the following:

Only foolish investors pursue casual attempts to beat the market, as such casual attempts provide the fodder for the skilled investors’ market-beating results. Even with adequate numbers of high-quality personnel, active management strategies demand uninstitutional behavior from institutions, creating a paradox few successfully unravel.

David Swenson – Pioneering Portfolio Management

David Swenson did a great job in the world of active management. But it’s not an easy game to play. It’s hard enough for an institution like Yale to succeed, much less an individual investor. So if you can’t devote a full measure of time, attention, hard work, and unconventional thinking towards the goal of active portfolio management, you’re better off sticking with a 100% passive investing strategy. The casual attempt is a recipe for disappointment.