I spoke with a person the other day who recently encountered a homeowner’s worst nightmare. Turns out, their dishwasher had a very slow leak that went unnoticed for a couple weeks. In the never ending battle to protect their house against water, the homeowner had suffered a surprise attack.

Of course the homeowner was upset about having the replace a busted dishwasher. But the bigger heartache came from the knock on effects of the slow leak.

Because the leak was hidden for so long, the wood floors around the dishwasher had warped and buckled. And the crawl space underneath the kitchen had a good amount of water in it. The homeowner had to do extensive work to dry everything out, protect against a potential mold infestation, and execute the proper repairs. The time and cost of addressing the clean up was substantial.

Slow leaks can also wreak havoc in our financial lives. Many issues may not seem like a big deal on the surface, but, unaddressed, they can create devastating consequences down the road.

Here are a some examples:

Investing and Asset based fees

If you have read this blog at all in the past, then you are well aware of my bias against the typical 1%-of-assets fee structure that many financial advisors use in their practices. And these asset based fees represent one of the most important financial slow leaks around. Many investors tell themselves, “It’s ONLY 1%, what’s the big deal?” But those 1% amounts add up year after year after year. What’s worse is any fees you pay also lose the ability to compound over time, so now compound growth is working against you instead of for you.

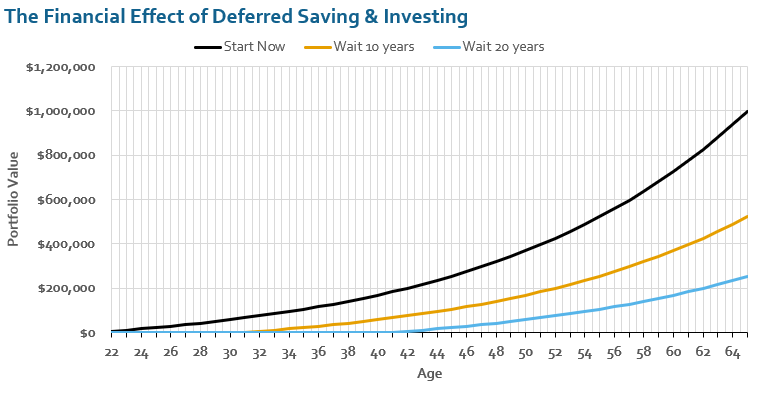

But asset based fees aren’t the only slow leak when it comes to investing. Let’s consider a new 22 year old college graduate that is entering the job market for the first time. What happens if that person starts saving for retirement now? What happens if they delay 10 or even 20 years?

The chart below illustrates the effects of deferred savings and investing. It assumes $5,000 annual contributions and a 6% rate of return.

As you can see, that slow leak of waiting to save and invest can have significant consequences. In this case, every 10 years of procrastination will cut the ending value of the portfolio in about half.

Insurance

Buying insurance is about as much fun as getting poked in the eye with a sharp stick. Yet, having the right insurance coverages can offer invaluable protection.

If you are in retirement and have built up a nice nest egg, you might think to yourself, “I don’t need umbrella liability insurance. Maybe I’ll skip it and save myself a few hundred bucks each year.” Warning! A slow leak has just started.

Of course skipping the insurance will work out fine for a while or even forever if you’re are lucky! But if you get in a bad car accident or someone gets hurt at your house, then you’ll wish you had the coverage. And you may not even end up needing to file a claim, but just having coverage could provide some serious peace of mind and save you from a boatload of worry and stress.

Estate planning

Do you (and your spouse) have a Will? When was it last updated? Does it still make sense with your current thinking? How do you want to approach end of life care? Who should help you make those decisions? Have you communicated your plans to loved ones?

In my experience, many, many people have avoided engaging with these questions. Why do today what you can put off until tomorrow, right? That’s fine within reason, but if you’ve been procrastinating for months or years, then you are in slow leak territory.

Why do I call an incomplete estate plan a slow leak? The answer lies in what’s left behind after you’ve gone. A bad estate plan can shatter family relationships. It can also chew up huge amounts of time and money as your executor attempts to figure everything out. I’ve experienced many instances where family members dealt with untold hassle to clean up a loved one’s estate, and that’s on top of trying to process feelings of grief and sadness.

Tax planning

Taxes can also cause a slow leak in your finances. If you fail to proactively plan for your tax obligations each year, then what sorts of benefits are you missing out on? Maybe none, but maybe lots. Tax laws change a lot. If you don’t plan around these changes, your finances can suffer.

Take Roth IRA conversions. Many people aren’t nearly as aggressive as they should be when it comes to planning the timing and amount of their Roth conversions. It’s tedious work that can involve a good deal of complexity. What’s more, a Roth conversion can generate a significant tax bill, and that’s never fun!

But handled in a reasonable manner, Roth conversions can play an important role in reducing your lifetime tax burden. If you don’t take a proactive approach to tax planning, then you are slowly leaking value over time.

Conclusion

Don’t let inertia ruin your finances. Make sure to engage with your financial plan at regular intervals. With some reading and hard work, you can do it yourself with no issues. Or hire a financial advisor. Planning can help uncover those slow leaks and fix them up so you don’t have to worry about a having to clean up the mess way down the road.