Here’s an interesting case study. Let’s imagine a fictional couple… we’ll call them John and Jane. John and Jane have worked hard throughout their career and are now entering retirement with the following basic parameters:

- Current investment portfolio totaling $3,000,000

- Annual need to withdraw $90,000 from their portfolio (adjusted for inflation) for living expenses

- Intend to donate $25,000 each year to charity (adjusted for inflation)

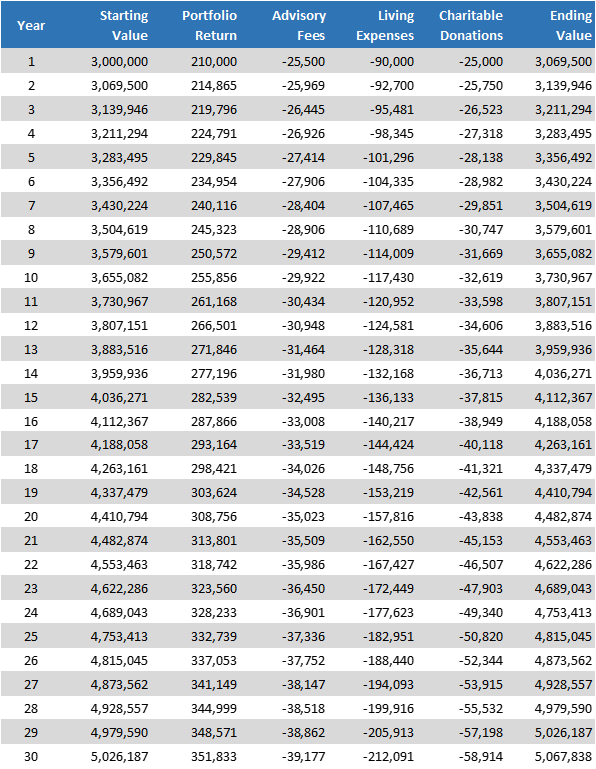

Scenario 1 – Typical asset-based financial advisor

Below is a basic retirement projection for John and Jane. It assumes they work with a typical financial advisor charging industy-average fees. For our purposes here, we’ll assume a 7% nominal return and 3% inflation:

Based on this, John and Jane will donate $1,189,385 to their preferred charitable organization(s) over a 30 year retirement. They will also end up with about $5 million of residual wealth. Not too bad.

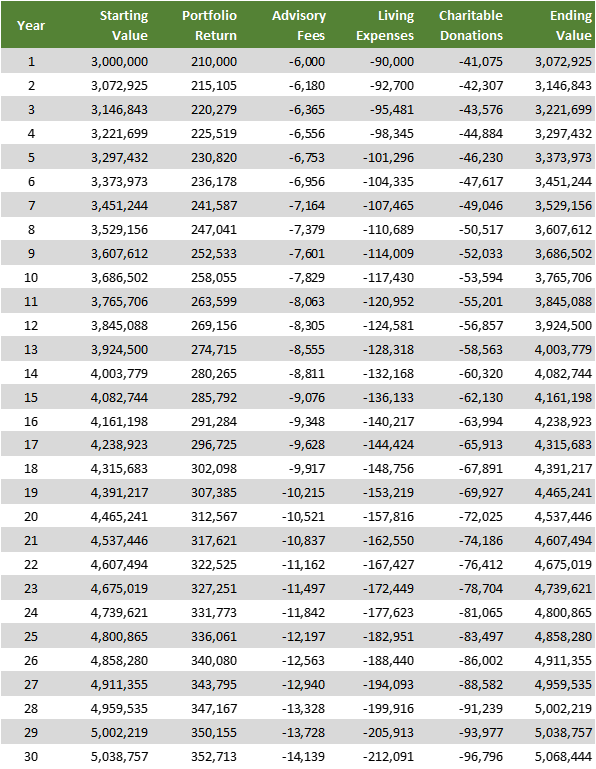

Scenario 2 – Flat fee advisor

Now let’s look at what happens if John and Jane decide to work with a flat fee financial advisor like my firm. We’ll use the same 7% return and 3% inflation as above:

In this case, John and Jane still end up with just over $5 million of residual wealth. However, now they are able to give $1,954,160 to charity. That’s a charitable boost of about $765,000. And that doesn’t even include the additional tax benefits. Let’s assume a constant 20% marginal tax rate. That will give John and Jane an additional $152,000 ($765,000 x 20%) of after-tax benefits. So at the end of their retirement, John and Jane end up with a total charitable boost of about $917,000.

Obviously, this is a very simplified example, but it offers a powerful lesson. By shopping around and paying a reasonable price for financial advice, John and Jane can significantly increase the value they provide to society. Their additional charitable contributions can help provide more opportunities to lift people out of poverty, reduce suffering, cure disease, and move society forward.