Late last year, Congress attempted to get rid of all backdoor Roth IRA contributions, but ultimately failed, for now. If you find yourself above the income limits for making a direct Roth IRA contribution, then it’s still possible to use the backdoor method.

Here are the modified adjusted gross income (MAGI) limits for 2022 (there is a phaseout range):

- Single: $129,000 – $143,999

- Married, filing jointly: $204,000 – $213,999

How should you go about executing a backdoor Roth IRA contribution? Let’s take a look.

#1 – Remove extra IRAs from the calculation

By far the biggest thing holding many high earners back from making backdoor Roth IRA contributions is the “pro rata” tax treatment of any IRA distributions. What this means is, if you have both pre-tax and after-tax dollars in your Traditional IRA, they are distributed on a pro rata basis. The IRS will not let you pick and choose whether after-tax or pre-tax dollars come out in the conversion. You can think about it like milk in your coffee. Once they are mixed, it’s impossible to separate them.

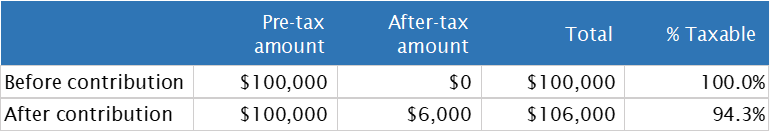

For example, let’s assume you have a Traditional IRA with $100,000 (all pre-tax). If you make a new non-deductible (or after-tax) contribution of $6,000, and then immediately try to convert it to a Roth IRA, then you will owe tax on 94.3% ($100,000 ÷ $106,000) of the amount.

Obviously, this defeats the purpose of doing the Roth conversion in the first place since you didn’t want to convert pre-tax amounts, rather just after-tax amounts. What are the best ways to handle this?

Option #1 – Convert an entire small account

If the amount of pre-tax dollars in your Traditional IRA is less than $10,000, then convert the entire amount and get it off your plate. You’ll pay a small amount of additional tax, but you’ll be simplifyng your finances and making things easier for future years of backdoor Roth contributions.

Option #2 – Rollover to your employer’s retirement plan

However, if your pre-tax IRA amounts are large, then converting everything could generate a significant tax headache. At that point, your best option becomes finding a 401(k) plan that will accept an incoming rollover of your pre-tax IRA assets. This is required because 401(k) plans are NOT included when making the pro rata distribution calculation.

Start by investigating your employer’s 401(k) plan. Ask your plan administrator or HR team if the plan accepts incoming transfers. If it does, then make sure that the plan also offers high-quality investment options and low fees. The last thing you want is to rollover your low-cost IRA into a high-cost 401(k) plan.

Option #3 – Rollover to a solo 401(k)

If you are self employed, or your employer doesn’t offer a 401(k) plan (or at least one that accepts rollovers), then you need to get more creative. Starting a small sole proprietor business could help. Visit the IRS website and get an Employer Identification Number (EIN). EIN’s are free, and you don’t need to set up an LLC or other corporate entity.

Once you have the new EIN, go forth and earn some money. Help your friend move a couch, volunteer for a medical trial, or fill out some online surveys. It doesn’t have to be much, but it will help if you document it. Your main goal is to pursue some semblance of a business. And with your new business, you are eligible to open a solo/individual 401(k) account and rollover your IRAs into it. Again, you’ll need to make sure the solo 401(k) provider you choose allows incoming rollovers, as not all of them do (top choices include Vanguard or Fidelity)

There are some drawbacks to this option. First, there is the hassle of extra paperwork, but it’s not too bad. You’ll need to report your business income (Schedule C) and self-employment taxes (Schedule SE) on your tax return. You’ll also need to file a 5500EZ if the plan assets exceed $250,000.

Second, the IRS may take a closer look at your tax return, although it’s not likely. I advise anyone considering this approach to discuss it with your CPA or tax advisor and maintain good records so you can justify everything in the event of an audit.

#2 – Make sure you have the right accounts set up

The next step is to make sure you have existing Traditional IRA and Roth IRA accounts set up prior to moving forward. If you don’t, go ahead and open them. Make sure both accounts are set up with the same custodian. This will make the process infinitely easier.

#3 – Make the non-deductible IRA contribution

Now you can make a non-deductible (aka after-tax) contribution to your Traditional IRA. If you’re married, you can make a contribution for your spouse as well. If you are over age 50, you can contribute an extra $1,000 as a catch up.

**Please note that it’s important to leave the money in cash. Investing the funds before the conversion is complete can make the reporting on your tax return more complicated.**

#4 – Execute the conversion

As soon as you’re able (typically within a few days), go ahead and request the transfer from your Traditional IRA to your Roth IRA. Do NOT withhold any taxes from transfer amount. Most custodians will show you a scary warning about taxes, but you can be confident that in this case your tax bill is zero.

Step Transaction Doctrine

One thing to note… in the past, some advisors would advise that you wait weeks or months before executing the conversion in order to avoid something called the “Step Transaction Doctrine.” This is where the IRS will look at substance over form. Or rather, they will look at all the steps mentioned here and say, “It looks like you are just trying to avoid the Roth IRA income limits, so we’re going to disallow that.” But over the past few years, the IRS has given explicit approval for backdoor Roth contributions, so there is no need to wait.

#5 – Invest

Once the funds have arrived in your Roth IRA, move forward with investing them in whatever fashion suits your portfolio and target asset allocation.

#6 – Get the tax reporting right

The last step in the process involves tax reporting (so much fun!). Any time you make a non-deductible IRA contribution, you need to file Form 8606 with your tax return (and one for your spouse as well). This form covers the pro rata rule we discussed earlier.

As backdoor Roth contributions are not that common, many CPAs aren’t familiar with the 8606. As a result, you’ll want to double check everything. For a standard contribution, here is what the 8606 will look like:

If you do your own taxes, then filling out the 8606 using most tax filing software can be tricky. Check out this tutorial if you need help.

Get it right the first time

It goes without saying that making a mistake during this process will generate a huge hassle and loss of time that could possibly outweigh any potential tax benefit. But if you do make a mistake, don’t panic. The most likely fix requires filing an amended tax return with correct amounts and the correct forms (i.e. 8606).

If you start the process, you’ll want to see it through to the end. If you make a non-deductible IRA contribution, but never transfer it to a Roth IRA, you likely would have been better off just saving in a taxable brokerage account instead.

This is also a situation where a knowledgeable financial advisor can help. They can walk you through the process and ensure everything goes smoothly.

Wait until later in the year… or not

For 2022, consider waiting until closer towards the end of the year before executing a backdoor Roth contribution. The reason for this is everything is still open to change. Congress could ultimately decide to outlaw this strategy and even make the new restriction retroactive to the January 1, 2022. The last thing you want is to deal with the hassle of having to unwind everything if the rules change.

But on the other hand, Congress could decide to “grandfather” in any backdoor Roth contributions that were completed before the legislation passed. All sorts of potential outcomes are on the table, so you’ll want to keep an eye on this throughout the year.